tax on venmo money

For most states the threshold is. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

Keep in mind that Venmo users paying.

. 9 2022 117 PM PT. Because of its setup Zelle claims that its payments. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider Paxos Trust Company.

All about taxes on Venmo. Now in addition to freelancers and. Are making real money in Horizon Worlds.

Citizen making money from the sale of goods or services the IRS considers it taxable income regardless of how or where youre paid. Millions of small business owners in America fell under the rules implemented last March as part of the. New Tax Rule.

Heres how you can avoid paying taxes when using Zelle Credit. Venmo business fees. Businesses using Venmo to pay employees should be sure to issue them a 1099-MISC form especially if you pay them more than 600 a year.

The tax code change requires the platforms to report anyone who has more than 600 in commercial payments a. Learn more about what tax. Later Venmo which is owned by PayPal came on the scene but it didnt.

Government passed legislation for 2022 as part of the American Rescue Plan Act that. Individuals who have sold cryptocurrency on Venmo during the 2021 tax year will receive a Gains and Losses Statement irrespective of their state of residence. Venmo charges a standard fee of 19 plus 010 USD on every seller transaction and this fee is non-refundable.

If youre a US. Use the Right Tax Form. Most people will not suffer any tax complications from the new IRS rules and in most cases you wont have to report that your.

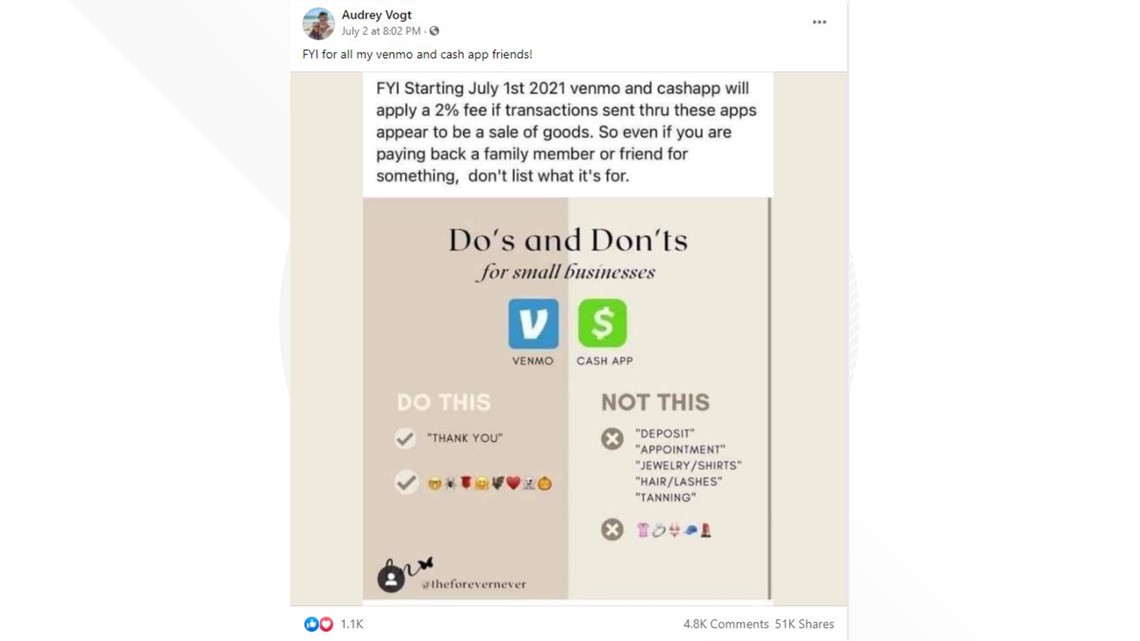

Venmo also has a 2022 Tax FAQ and an explainer on what else you can expect this tax season. The move can certainly send panic shivers down the spine. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

You Might Have To Pay More in Taxes. Ensure Your Venmo Transactions Arent Accidentally Taxed. PayPal as one example gives users the option to set up both business and personal accounts.

That loophole is Zelle a bank-to-bank payment service that does not hold funds. Venmo is a service of PayPal Inc a licensed provider of money transfer services NMLS ID. Once you are ready to file your taxes various online services can help.

Consider seeking advice from your financial and tax advisor. Those fears are largely unwarranted. To report or pay taxes.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

New Rule To Require Irs Tax On Cash App Business Transactions Wciv

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Getting Paid On Venmo Or Cash App There S A Tax For That The Jerusalem Post

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Fact Check Treasury Proposal Wouldn T Levy New Tax On Paypal Venmo

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

The Irs Is Not Taxing Venmo Zelle Cash App Transactions Khou Com

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

The Irs Crackdown On Venmo Zelle Payments Mendoza Company Inc

Major Tax Reporting Change For Users Of Venmo Paypal And Others

Send Cash So I Ll Know You Are Ok

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

Does The Irs Want To Tax Your Venmo Not Exactly

Venmo Zelle Paypal Apple Pay And More Best P2p Services

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance